Today's solar boom has been developing slowly and methodically over the past three decades. Many individuals and companies have been quietly preparing for the commercial acceptance that is finally at hand. These wise men are crafting their dreams into reality.

Today's solar boom has been developing slowly and methodically over the past three decades. Many individuals and companies have been quietly preparing for the commercial acceptance that is finally at hand. These wise men are crafting their dreams into reality.Unfortunately, the kind of transition to acceptance they envisioned will never come. What will come is something completely different.

The Lesson

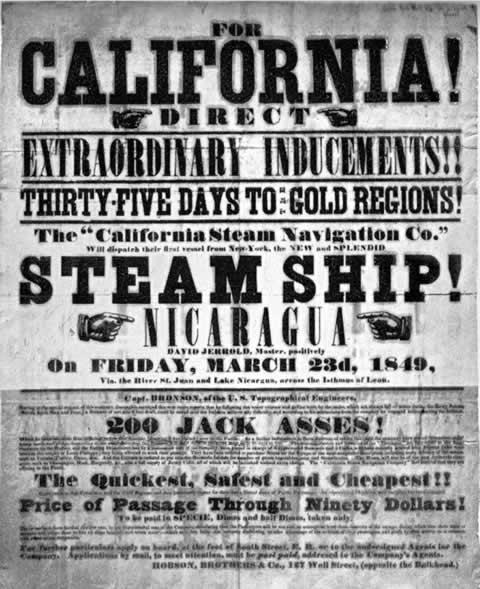

Imagine that, in 1847, the US Government decided to populate California. Their sensible heads would have suggested a careful plan involving the preplacement of law enforcement, schools and local government services. Along with that, they might have put in place plans to insure the suitable housing and churches were waiting the new settlers. Doctors, engineers, lawyers and teachers would be encouraged to make the trip. The increased flow of settlers could have been optimistically estimated to be a healthy, sustainable few hundreds per year. All very sensible and reasonable.

But those plans, if laid, were superseded when the prospect of gold entered the equation. Tales of instant wealth and rivers flowing with gold spread across the world, inspiring tens of thousands from every walk of life to abandon normal lives and productive work. They crossed the oceans and crossed the continent knowing that all of their party might not survive the trip. They arrived at boom towns ill suited to feed and clothe the would-be miners, let alone protect any resulting property. But still they came. Over four years, a hundred thousand gold-seekers found their way against all odds (and all economic sense) to seek gold.

Gold Fever is a primitive and irresistible force. People will do wild and unlikely things that sensible heads would never predict to find "gold". Laws laid down beforehand may not be regarded as binding.

Gold Fever is a primitive and irresistible force. People will do wild and unlikely things that sensible heads would never predict to find "gold". Laws laid down beforehand may not be regarded as binding.But from this chaos, prosperity did eventually come. A quick minded few made fortunes selling picks, shovels, food and clothing to the gold seekers. In time, order was restored.

The Present

With the age of economic solar energy upon us, there will be talk of "Gold from the Blue Sky"(tm). Its a claim worthy of the of California Gold Rush hyperbole. Only this time it is true:

Converted into its cash equivalent, solar energy falls on your rooftop like a light rain of pennies, gathering about $25 every daylight hour.

So prepare for another Gold Rush. But this time the masses won't just be coming to California. They will be entering the solar business in every corner of the global market. Over the past year, some wise heads have suggested moderation in forecasting this new industry. They remind us that it takes time to build proper factories, supply chains and customer awareness. With confident certainty, they point out that the supply of silicon itself is currently constrained and all incumbent members of the supply chain worldwide are operating at capacity. Some of the most likely companies to successfully enter the solar arena (experts in semiconductor manufacturing such as IBM, Intel and TSMC) are only just starting to explore the issue -if at all. The wise heads are justified in their assurance of moderation. It would seem that even hitting a mere 20% solar target by 2020 is could be overly ambitious.

The valiant incumbents of the solar industry will enjoy a brief surge of success as customer adoption explodes. However, their decades of momentum with conventional approaches to this business will be surpassed by new entrants who will have no problem rewriting the rules. Just as bank tellers and farmers walked across burning deserts to become gold miners, wild-eyed companies and investors with no prior experience or interest in solar (or Green) will hurl themselves into the mix. Without pre-existing notions of fair play or a sense of community, the new entrants will write their own rules. They will do unexpected things, bringing practices from their native business environments. (How will a Chinese towel manufacturer behave on the solar playing field?) They will innovate in unconventional ways. The status quo will be left behind.

As the solar gold rush begins, the giant solar incumbents such a Sharp are making more money than they ever have before. While they celebrate their long sought success, new companies such a SunPower (with its record holding high efficiency cells), and Miasole (who aspires to develop an entire new material technology for solar), will soon pass the incumbents in the marketplace.

Consider the story of LDK Solar. In January of 2005, just as the industry was warning that supply constraints would cap growth to just 5% for 2006, LDK Solar was founded in China by by a man living in the United States. He had no experience with semiconductor technology or manufacturing. He had no preconceptions. LDK found a growth-positive community with no manufacturing employment base that sought to participate in the new solar industry. Thus, LDK enjoyed a motivated permitting process measured in days rather than years and a school system that would redirect itself to training workers for LDKs enormous factory. Founded in 2005, LDK went from an empty field field to an NYSE IPO (It was too large for NASDAQ.) on June 4, 2007 with a market cap of $4B. LDKs capacity is sold out sold through 2009.

This has all happened before, but never before has the pattern been so recognizable in advance. The same forces that have always conspired against incumbents are still in place. Sharp and Kyocera could invest substantial R&D into CIGS based cells and use their operational effectiveness to squash Silicon Valley upstarts. For that matter, a Petroleum Energy such as Exxon could tap its record profits of late and simply acquire the top contenders in every segment of solar. But they won't, and even if the incumbents try to keep up, the upstarts will simply move faster, changing the game in the quest for gold.

One hard to accept lesson from Gold Rushes of the past is the greatest fortunes were not made from finding gold at all, but from the selling of picks and shovels.

Perhaps this time the fortune winner will the happy consumer, whistling cheerfully as he farms pennies from his roof every sunny day.

No comments:

Post a Comment